Monetary Know-how, or FinTech, is within the relentless state of evolution. This textual content factors out rising tendencies which can outline the way forward for FinTech and provides a course-changing increase to how all of us work collectively with cash. Immediately, technological know-how modifications the monetary panorama. Subsequently, it addresses rising tendencies which can be going to outline the way forward for FinTech and provides a course-changing increase to how we all work with cash.

Blockchain and Decentralized Finance (DeFi):

1.1. Decentralized Finance (DeFi):

Increased decentralized monetary corporations let actions like lending, borrowing, and selling happen with no conventional intermediaries.

Blockchain platforms run transparent, self-executing financial transactions via smart contracts.

1.2 Central Bank Digital Currencies (CBDCs):

Governments are looking into the possibility of digital versions of their national currencies.

CBDCs will make transactions more efficient and secure and will bring new possibilities for financial policy.

Artificial Intelligence and Machine Learning:

2.1 Personalised Monetary Providers:

AI-driven algorithms that provide tailor-made monetary advice, investment strategies, and customized banking experience to individuals based on their preferences and behaviors.

Predictive analytics enhances risk assessment and fraud detection.

2.2 Chatbots and Digital Assistants:

Growing deployment of AI-powered chatbots and digital assistants across customer support to provide quicker responses and question selection.

Enhancing the user experience through natural language processing and comprehension.

Open Banking and APIs:

3.1 Interconnected Financial Ecosystems:

The way that now is all about the secure sharing of monetary institutions’ buyer information via utility programming interfaces (APIs) is Open Banking.

Innovative development by way of enabling third-party builders to create new monetary companies.

3.2 Improved Customer Experience:

Open banking results in higher buyer experiences in easy, built-in monetary companies.

Rising competitors amongst Monetary Establishments to innovate and prospect orientation.

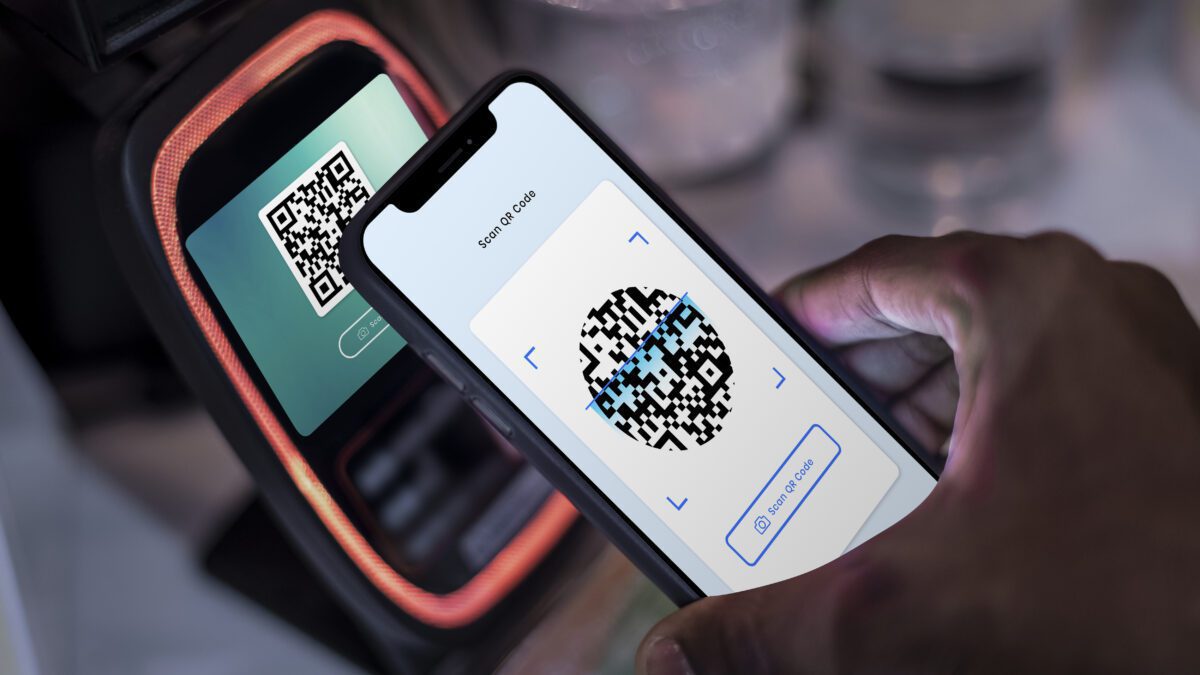

Massive utilization of contactless fee strategies reduces dependency on bodily foreign money.

A blend of digital wallets with contactless technology to bring safe and convenient payment solutions.

4.2 Integration of Cryptocurrency:

Digital Wallets would be developed supporting Cryptocurrencies wherein users can manage traditional and digital assets via one platform.

Cryptocurrencies grow in the mainstream as a means of payment.

RPA and Robo-Advisors:

5.1 Lean Operations:

RPA integrated to automate routine monetary duties, decreasing processing instances, and operational costs.

Robo-advisors leveraging algorithms to offer automated algorithm-driven monetary planning companies.

5.2 Algorithmic Buying and Selling:

An increased presence of algorithms in buying and selling, for evaluation of huge information, recognizing patterns, and execution of trades at the optimum occasions.

Algorithmic buying and selling contributing to liquidity and effectivity of monetary markets.

RegTech (Regulatory Know-how):

6.1 Compliance Automation:

Mechanization of the methods of regulatory compliance through know-how, making certain adherence to evolving monetary rules.

Improved danger administration and reporting through RegTech options.

6.2 Cybersecurity Measures:

Built-in superior cyber safety devices shield the monetary establishments and their clients from cyber threats.

Continuous monitoring and proactive measures for defense against cyber-attacks on sensitive financial information.

Sustainable and ESG Investing:

7.1 Developments in Environmental, Social, and Governance Requirements:

Growing emphasis on sustainable and socially responsible investing with increasing consideration of ESG in investment decisions.

FinTech platforms arm investors with the power to track and analyze environmental impact caused by their investment portfolios.

7.2 Green FinTech Initiatives:

Trending of FinTech solutions that promote environmentally friendly practices.

Platforms for green investments in companies focused on sustainability.

Neobanking and digital-only monetary establishments have grown in recent times, which supply a spread of monetary companies with out any brick-and-mortar conventional branches.

Improved person expertise, modern options, and transparency within the construction of the prices.

8.2 Monetary Inclusion:

Neobanks contributing to monetary inclusion by offering companies to underserved populations.

In this way, mobile applications reduce most of the barriers that exist to accessing the banking companies. Conclusion: Navigating the Way forward for FinTech

On this note, efficiency, accessibility, and innovation in the future of FinTech will further spread within the financial sector. Much the same as blockchain reshapes conventional finance, AI personalizes experiences, and open banking fosters collaboration, the new financial landscape shall be dynamic and interlinked for people and businesses. Appreciating these trends and adjusting to them within new technologies will be imperative—to move along with these changes in this world of FinTech and unleash its power for transformative change in financing empowerment.

Stay connected